Sustainability Related Disclosures

Disclosures pursuant to Regulation (EU) 2019/2088

Updated April, 9, 2025

The following three chapters cover the disclosure requirements on entity level (i.e. the Green Generation Management GmbH) in accordance with Articles 3, 4 and 5 of the Sustainable Finance Disclosure Regulation (EU) 2019/2088 (SFDR).

Transparency of sustainability risk policies (Article 3)

To ensure impactful and meaningful investments, Green Generation Management GmbH has developed a multidimensional impact assessment in order to align with advanced frameworks and regulations. This approach also considers sustainability risks, setting strict standards for the financial product and investments.

As part of the due diligence process, sustainability risks are taken into account including evidence, external, stakeholder participation, drop-off, efficiency, execution, alignment, endurance, and unexpected impact risks. Sustainability risks as defined by Art. 2 (22) SFDR are environmental, social or governance events or conditions that, should they occur, could cause an actual or a potential material negative effect on the investments’ value. Evaluating and supporting opportunities to enhance value creation through sustainable practices by setting ambitious improvement targets can have a positive impact on the Fund’s financial performance. The risk score of these assessments guide investment decisions. In its free discretion, Green Generation Management GmbH may decide to make an investment even if sustainability risks have been determined. In such cases, appropriate mitigation measures may be applied.

Transparency of adverse sustainability impacts at entity level (Article 4)

Green Generation Management GmbH considers principal adverse impacts of its investment decisions on sustainability factors. For this, mandatory and selected optional ‘Principal Adverse Impacts’ (PAIs) on sustainability factors will be taken into account within the monitoring process. Sustainability factors are defined as “environmental, social and employee concerns, respect for human rights and the fight against corruption and bribery” (Art. 2 (24) SFDR). All investees are required to report on PAI sustainability factors with the beginning of the holding period at least once per year. If significant adverse impacts on sustainability factors are identified, the Green Generation fund develops a mitigation strategy together with the portfolio company’s sustainability team. If that is not feasible, the investment opportunity is not pursued further.

Statement on principal adverse impacts (PAIs) of investment decisions on sustainability factors

Transparency of remuneration policies in relation to the integration of sustainability risks (Article 5)

The Green Generation Management GmbH has established remuneration policies that are consistent with the ESG and impact strategy and linked to the achievement of specific impact targets and thus incentivize investment professionals to promote sustainable growth within investments. Remuneration is based on a management fee concept, that is charged by the Fund. An additional carried interest is charged upon reaching an annual hurdle rate. Once the total fund return exceeds a certain threshold, the carried interest increases further. One third of the carried interest will be directly linked to the achievement of pre-defined climate and environmental impact targets and related KPIs. In case these are not or only partly achieved, the respective part of the carried interest which is not distributed will be transferred to an independent beneficiary (e.g. a NGO, a climate and environmental Business, a climate and environmental business incubator, etc.) proposed by the Fund and approved by LPs.

Website Disclosures on product level

The following chapters cover the disclosure requirements on financial product level (i.e. the Green Generation Fund GmbH & Co. KG; Legal Entity Identifier: 984500FB3A2JNFE8F166) in accordance with Article 10 of the Sustainable Finance Disclosure Regulation (EU) 2019/2088.

1. Summary

The Green Generation Fund GmbH & Co. KG (the ‘Fund’, ‘Green Generation’ or ‘GGF’) is structured as a German limited partnership and managed by Green Generation Management GmbH. The Fund focuses on building a robust start-up ecosystem in Food Tech, Health Care & Wellbeing, and Green Tech, aiming to significantly contribute to the UN Sustainable Development Goals (SDGs) and prevent crossing planetary boundaries through sustainable investments. Green Generation avoids investing in industries like alcohol, tobacco, gambling, weapons, pornography, and fossil fuels, ensuring alignment with its sustainable investment objectives through comprehensive environmental impact assessments and due diligence of portfolio companies. These assessments consider potential adverse effects on environmental, social, and governance (ESG) issues, influencing investment decisions.

The Fund’s sustainable investment objectives aim to reducing carbon emissions, preserving resources, and creating responsible workplaces and therefore generate significant positive and measurable environmental and social outcomes, guided by its Five Impact Principles: Climate Stability, Resource Exploitation, Biodiversity Protection, Health and Welfare, and Responsible Work. These principles align with specific SDGs and focus on reducing greenhouse gas emissions, promoting sustainable resource use, enhancing biodiversity, improving health and welfare, and supporting responsible work practices. The fund targets early-stage start-ups in Europe and the United States, partnering with sustainability pioneers in emerging food technology, healthcare technology, and green technology companies.

In accordance with its investment strategy, the Green Generation Fund intends to only invest in impact start-ups striving to achieve a significant, positive, and measurable social and/or environmental impact and attaining its sustainable investment objectives, while not allocating capital to other asset classes. The Fund does not pursue Taxonomy-alignment.

The Green Generation Fund considers key adverse impacts on sustainability factors through impact due diligence prior to the investment as well as annual negative screening of portfolio companies against the do not significant harm principles, mandatory Principal Adverse Indicators, the Fund’s exclusion criteria and assessment of good governance practices in line with international standards.

The Fund’s environmental and social contribution is defined and monitored through the Fund’s Five Impact Principles as well as through its Impact Framework and related KPIs, employing questionnaires and third-party verification to assess impact contributions. The Fund’s Impact Framework guides materiality assessments, sustainability risk identification, and impact performance evaluations, sourcing data from portfolio companies, scientific studies, and real-world data.

While the Fund does not have a dedicated engagement policy, the Green Generation Fund actively engages in advocacy to strengthen social entrepreneurship, scientific impact measurement standards, and environmental legislation. The fund adheres to ESG principles and encourages portfolio companies to align with its Impact & ESG Policy, conducting related training sessions where appropriate. The attainment of the sustainable investment objectives is measured in specific units like tons of emissions reduced or hours of sustainable education provided. The Fund ties its carried interest to achieving impact KPIs, reinforcing its commitment to supporting a global economy within planetary boundaries and addressing the climate crisis.

Die Green Generation Fund GmbH & Co. KG ist als deutsche Kapitalgesellschaft strukturiert und wird von der Green Generation Management GmbH verwaltet. Der Fonds konzentriert sich auf den systematischen Ausbau eines stabilen Start-up-Ökosystems in den Bereichen Food Tech, Health Care & Wellbeing und Green Tech, um einen substanziellen Beitrag zu den UN-Nachhaltigkeitszielen (Sustainable Development Goals, SDGs) zu leisten und die Überschreitung der planetarischen Grenzen durch nachhaltige Investitionen zu verhindern. Green Generation schließt Investitionen in Branchen wie Alkohol, Tabak, Glücksspiel, Waffen, Pornografie und fossile Brennstoffe aus und stellt durch umfassende Bewertungen der Umweltauswirkungen und Due-Diligence-Prüfungen der Portfoliounternehmen sicher, dass diese mit den nachhaltigen Investitionszielen übereinstimmen. Bei diesen Bewertungen werden potenzielle negative Auswirkungen auf Umwelt, soziale Belange und verantwortungsvolle Unternehmensführung (ESG) berücksichtigt, die in die Investitionsentscheidungen einfließen.

Die nachhaltigen Investitionsziele des Fonds zielen darauf ab, CO2-Emissionen zu reduzieren, Ressourcen zu schonen und verantwortungsvolle Arbeitsplätze zu schaffen und somit signifikante positive und messbare ökologische und soziale Wirkungen zu erzielen, die sich an den fünf Impact-Prinzipien des Fonds orientieren: Klimastabilität, Ressourcenausbeutung, Schutz der Biodiversität, Gesundheit und Wohlbefinden sowie verantwortungsvolle Arbeit. Diese Prinzipien richten sich nach spezifischen SDGs und betreffen die Verringerung von Treibhausgasemissionen, die Förderung einer nachhaltigen Ressourcennutzung, die Stärkung biologischer Vielfalt, die Verbesserung von Gesundheit und Wohlergehen und die Unterstützung verantwortungsvoller Arbeitsmethoden.

Der Fonds konzentriert sich auf Start-ups in Europa und den USA, die sich in der Frühphase befinden, und strebt Partnerschaften mit Unternehmen an, die in den Bereichen Lebensmitteltechnologie, Gesundheitstechnologie und grüne Technologien Pionierarbeit leisten. Es wird keine Konformität mit der EU-Taxonomie angestrebt.

Der Green Generation Fund berücksichtigt wesentliche negative Auswirkungen auf Nachhaltigkeitsfaktoren durch Due-Diligence-Prüfungen vor der Investition sowie durch ein jährliches Negativ-Screening der Portfoliounternehmen anhand der „Do not significant harm“-Grundsätze, der obligatorischen „Principal Adverse Indicators“, der Ausschlusskriterien des Fonds sowie der Bewertung von Good-Governance-Praktiken in Übereinstimmung mit internationalen Standards.

Der ökologische und soziale Beitrag des Fonds wird durch die fünf Impact-Prinzipien des Fonds sowie durch das Impact Framework und damit zusammenhängende KPIs definiert und überwacht, wobei Fragebögen und die Verifizierung durch Dritte zur Bewertung der Impact-Beiträge eingesetzt werden. Das Impact Framework des Fonds dient als Leitfaden für die Bewertung der Wesentlichkeit, die Identifizierung von Nachhaltigkeitsrisiken und die Bewertung der Auswirkungen, wobei Daten von Portfoliounternehmen, wissenschaftliche Studien und reale Daten herangezogen werden.

Auch wenn der Fund keine separate Mitwirkungspolitik hat, setzt sich der Green Generation Fund aktiv für die Stärkung des sozialen Unternehmertums, für wissenschaftliche Standards zur Wirkungsmessung und für umweltrechtliche Vorschriften ein. Der Fonds ermutigt seine Portfoliounternehmen, ESG-Prinzipien zu befolgen, und führt gegebenenfalls entsprechende Schulungen durch, um die Übereinstimmung mit seiner Impact & ESG-Politik zu gewährleisten. Green Generation hält seine Portfoliounternehmen an, im Einklang mit der Impact & ESG-Politik des Funds zu handeln und führt gegebenenfalls entsprechende Schulungen durch.

Das Erreichen der nachhaltigen Anlageziele wird in spezifischen Einheiten gemessen, z. B. in Tonnen reduzierter Emissionen oder in Stunden nachhaltiger Bildung. Der Fonds knüpft seine Gewinnbeteiligung an die Erreichung von Impact-KPIs und unterstreicht damit sein Engagement für eine globale Wirtschaft innerhalb der planetarischen Grenzen und die Bewältigung der Klimakrise.

2. No significant harm to the sustainable investment objective

Green Generation Fund does not invest, guarantee, or otherwise provide financial or other support, directly or indirectly, to companies, including portfolio companies, or other entities whose business activity consists of: Alcohol and Tobacco, Gambling, Weapons, Pornography, Fossil fuels and Distilled Alcohol. To exclude any possible negative effects and to uncover as well as quantify adverse environmental effects, GGF conducts an environmental impact assessment of portfolio companies’ products and/or services. GGF also assesses potential adverse effects in regard to environmental, social and governance issues during its due diligence and considers the results in investment decisions. For that purpose, a dedicated questionnaire has been integrated in the pre-investment due diligence as well as in the post-investment monitoring and support processes. Portfolio companies are committed to providing the necessary data by signing the term sheet and shareholder agreement. Given that the Fund invests in start-ups in very early stages- often just consisting of a team and an idea- impact forecasting involves assumptions and predictions which may or may not materialize.

The Green Generation Fund considers key adverse impacts on sustainability factors through impact due diligence prior to the investment as well as annual negative screening of portfolio companies against the DNSH Principles, mandatory Principal Adverse Indicators (PAI), the Fund’s exclusion criteria and verification of compliance with the OECD Guidelines for Multinational Enterprises and the United Nations Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight fundamental conventions identified in the Declaration of the International Labor Organization on Fundamental Principles and Rights at Work and the International Bill of Human Rights.

3. Sustainable investment objectives of the financial product

The Fund’s investments not only avoid harm, but also generate significant positive and measurable environmental and/or social outcomes for the planet. A “significant” outcome means a product or service will lead to considerable reductions in at least one of five key areas, defined in the following as the Fund’s Five Impact Principles within a timeframe of eight years:

- Climate Stability – active contribution to SDG 7 (“affordable and clean energy”) and SDG 13 (“climate action”) by reducing, removing, or mitigating GHG emissions while preventing carbon lock-in, and increasing the resilience of systems to adapt to climate change.

- Resource Exploitation – active contribution to SDG 6 (“clean water and sanitization”) and SDG 12 (“responsible consumption and production”) by reducing waste, supporting a circular economy, promoting sustainable water use or decreasing the use of finite resources

- Biodiversity Protection – active contribution to SDG 14 (“life below water”) and SDG 15 (“life on land”) by protecting and enhancing biodiversity and avoiding soil erosion by restoring destroyed and degraded ecosystems.

- Health and Welfare – active contribution to SDG 3 (“good health and well-being”) and SDG 2 (“zero hunger”) by providing healthy and alternative nutrition for every living being and/ or promoting physical and mental health.

- Responsible Work – active contribution to SDG 5 (“gender equality”) and SDG 8 (“decent work and economic growth”) by supporting social/environmental- economic balance including the creation of and increased access to economic opportunities for minorities, by increasing prosperity in harmony with the environment.

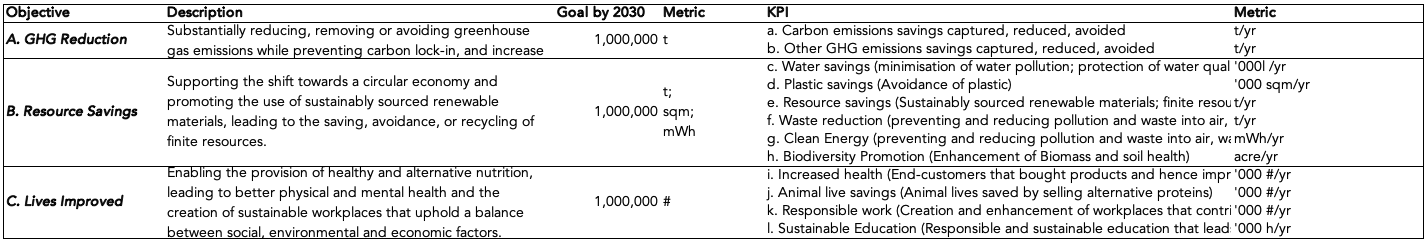

“Positive” impact refers to a product or service that addresses a systematic challenge in Europe and the United States, such as climate change, environmental protection, and inequality of opportunity. “Measurable” impact defines a product or service whose effects can be quantified, and a company whose founding team has expressed a robust commitment to measuring and managing its impact. The Fund wants to contribute to an economy that operates within the planetary boundaries, preserve the 17 Sustainable Development Goals (SDGs) and contribute to an incremental sustainable change within the financial market. Therefore, the fund contributes within the five key areas to three impact objectives:

4. Investment strategy

The Fund invests exclusively in early-stage start-ups originating primarily in Europe and the United States that:

- have the potential to create positive impact in at least one of the following key areas: GHG reduction, resource conservation, biodiversity protection, health & welfare of living beings, responsible work. Impacts on the environment and/or human health must be quantifiable;

- have a strong team/founder with a vision to be future leaders in existing verticals or building deep-tech products to create a new vertical; and

- have high growth potential.

GGF partners with sustainability pioneers with a special focus on emerging food technology, healthcare technology and green technology companies. The Fund intends to make its initial investments in the early stages of a company, i.e., pre-seed, seed and series A rounds. The Fund’s focus on impact is anchored in every aspect of the investment process – from the initial screening, the establishment of impact KPIs at the closing of the deal, all the way to impact monitoring during the holding period and an impact evaluation as well as carry claw back at the time of exit. Green Generation Fund implements the Fund’s investment strategy in compliance with the Fund’s limited partnerships agreement and the Fund’s ESG & Impact policy.

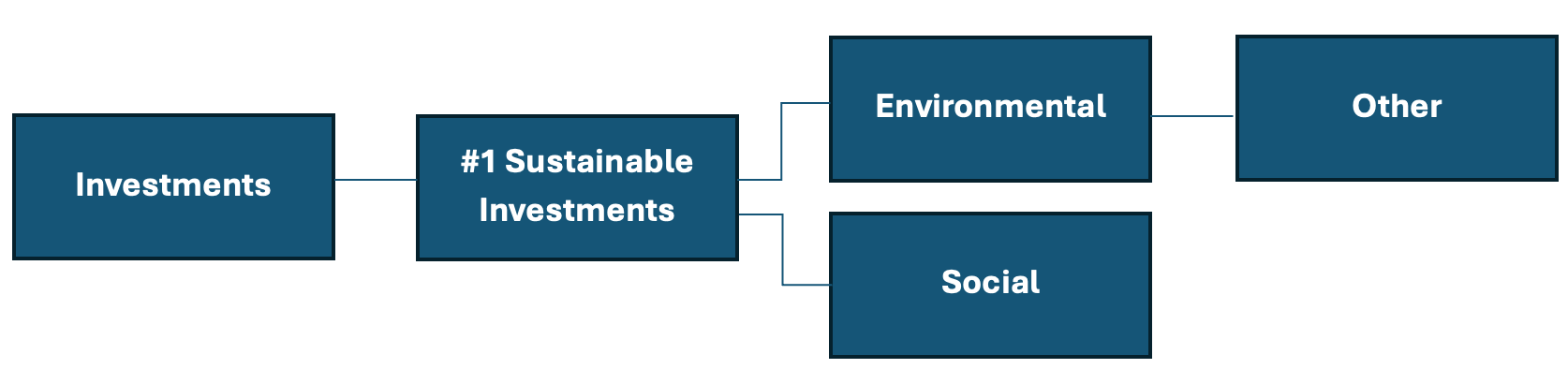

The Fund invests at least 80% of its net assets in economic activities that qualify as sustainable investments within the meaning of Article 2(17) of the SFDR and pursue environmental or social objectives. The investment strategy is based on clearly defined selection criteria and excludes companies that violate internationally recognized standards. Specifically, the exclusions set out in Article 12(1)(a)–(g) of Delegated Regulation (EU) 2020/1818 apply.

5. Proportion of investments

In accordance with its investment strategy, the Green Generation Fund intends to invest 100% of the Fund’s resources in impact start-ups striving to achieve a significant, positive, and measurable social and/or environmental impact and attaining its sustainable investment objectives, while not allocating capital to other asset classes. The Fund does not pursue Taxonomy-alignment and defines its environmental and social contribution through the Fund’s Five Impact Principles (see “Sustainable investment objectives of the financial product” above) as well as through its Impact Framework (see chapter “Methodologies” below). The Green Generation Fund does only invest directly through its own Fund in early-stage start-ups.

The Fund intends to invest at least 80% of its net assets in assets that qualify as sustainable investments within the meaning of Article 2(17) of the SFDR and pursue a sustainable environmental or social objective.

6. Monitoring of sustainable investment objectives

Throughout the entire investment process, the investment team is guided by the Fund’s Five Impact Principles and the related impact objectives and KPIs. Contribution to impact is monitored by questionnaires and verified by third parties. In addition to the impact monitoring, ESG questionnaires are used initially within the due diligence process and, following an investment, at regular intervals. The ESG data are the building blocks of the Fund’s Impact framework that leads to materiality assessment, sustainability risk identification process and to the impact performance of each portfolio company. The impact performance provides data about the impact objectives, contribution and net impact and will be used to model LCAs for each investment. Results from this Impact Assessment will be provided to the Fund’s limited partner advisory committee (LPAC) on regular intervals.

7. Methodologies

The Green Generation Fund implemented an Impact Framework consisting of widely accepted impact metric systems (e.g. non-financial reports, Theory of Change, CEI User Guidelines of the EIF) which assesses the environmental and social impacts associated with all stages of a product’s lifecycle. An Impact Team (consisting of the head of impact, a senior team member and a working student) develops and executes these impact assessments together with the management team of the portfolio company, defines 1-5 impact goals to be continuously tracked by the portfolio company and reported on an at least annual basis, alongside financial KPIs. These KPIs are measurable and linked to the social and/or environmental outcome(s) the portfolio company aims to achieve.

8. Data sources and processing

To forecast the impact assessment, data on the start-up’s product or service is sourced from the company itself. Where there is no specific data available on production processes and resources used, the data is modelled or sourced from peer reviewed scientific studies, real- world baseline data, and assumptions about the portfolio company’s growth. In exceptional circumstances, if portfolio companies are unable to provide this data, the Fund may estimate impact KPIs based on the portfolio company’s historic impact performance and company growth data. Impact assessment data and models are updated on a regular basis in consultation with the portfolio companies to reflect changes in the start-up’s processes or products. In addition, target markets of start-ups are being monitored to detect and include significant changes that might affect the environmental performance of a portfolio company.

9. Limitations to methodologies and data

The Green Generation Fund is implementing a science-based impact methodology for investments. Nevertheless, the assessment of the potential impact of a possible investment and its impact risk is limited by the quality of the information made available by the potential investment. Where low-quality or incomplete information has been provided, the Fund will look for suitable benchmarks and relevant external data points. In cases where impact cannot be easily defined and measured, the Fund will encourage the portfolio company’s management to define suitable proxies.

10. Due Diligence

The Fund conducts due diligence for financial, legal and commercial, intellectual property, technical, as well as ESG and impact matters. A full Impact Assessment and forecasting of the startup’s product or service is being developed by the Fund’s Impact Team and is included during the Impact Assessment.

11. Engagement Policies

We will actively communicate and publish our ambitions and findings. This will also include advocacy to strengthen social entrepreneurship, purpose companies, scientific impact measurement standards as well as more ambitious environmental legislation. We commit to adhering to ESG principles with regard to our own organization as well as the Fund. As a venture capital investor, the influence we have on the Fund’s portfolio companies through shareholdings of our funds, including influence on sustainability matters, is typically limited. However, we shall apply our best efforts to encourage our portfolio companies to agree with our Impact & ESG Policy within the signing of the term sheet and shareholder agreements, and to commit to pursuing Impact & ESG targets. Where appropriate, we will conduct training sessions for portfolio companies on how to handle Impact & ESG related issues. Prior to placing an investment, evaluating founders’ attitude towards Impact and ESG is a priority for the Green Generation Fund. Following an investment and during the holding period, the Fund intends to maintain trust and a strong working relationship with the management and impact teams of its portfolio companies.

12. Attainment of the sustainable investment objective

As an impact venture capital firm and through its investments in early-stage companies, Green Generation Fund has the clear objective to reduce carbon emissions in line with long- term global warming objectives stipulated in the Paris Agreement. As a second objective, the Fund aims to preserve, protect and recycle finite resources to neither harm the ecological environment nor affect biodiversity. Creating responsible workplaces that fight inequality, preserve the 17 Sustainable Development Goals and contribute to better life quality is the Fund’s third objective. The first and second objective will be measured in tons/yr, ltr/yr, sqm/yr or mWh/yr whilst the third objective will be measured by the number of living beings positively affected (#/yr) and hours of sustainable education (h/yr). To attain and improve these objectives, the Fund will measure, assess and verify them on a regular basis within our Impact Framework. By following our mission to support the transition to a global economy that operates within the planetary boundaries, we will not invest in companies that are not part of the solution to the climate crisis. We tie our carried interest to achieving our impact KPIs.

This document has been uploaded on 09.04.2025.

Version history of website disclosures:

| Version No. | Date of publication | Amendments to previous versions |

| 01 | October 2022 | – |

| 02 | October 2023 | – |

| 03 | 15.07.2024 | General structure: Website disclosures have been divided into disclosures on entity-level acc. to Art. 3, 4 and 5 SFDR and disclosures on product level acc. to Art. 10 SFDR. In this context, chapter headings in this disclosure document were harmonised and reordered in line with the requirements of Art. 37 of the Delegated Act. For both chapters (entity-and product-level) introduction sentences have been added that refer to the respective regulatory requirement as well as indication of the Legal Entity Identifier of the financial product considered. The content of the former chapters 2 (Consideration of Principal Adverse Impact Indicators) and 3 (Sustainability risks) have been relocated to Art. 3 (Transparency of sustainability risk policies) and Art. 4 (Transparency of adverse sustainability impacts at entity level) and partially rephrased to align with disclosure requirements of the respective articles. |

| Disclosure on entity-level Art. 3 Transparency of sustainability risk policies: Information from previous chapter 3 (Sustainability risks) was included for the disclosure requirement under Art. 3 SFDR and supplemented by leading context on the applied multidimensional impact assessment approach. | ||

| Disclosure on entity level Article 4: Transparency of adverse sustainability impacts at entity level: Information on the consideration of principal adverse impacts on sustainability factors has been included acc. to requirements set out in Art. 4 para. 2 a-d. | ||

| Disclosure on entity level Article 5: Transparency of remuneration policies in relation to the integration of sustainability risks: Disclosure on remuneration policies information and their consistency with the integration of sustainability factors has been included. | ||

| Disclosure on product level Chapter 2: No significant harm to the sustainable investment objective: Second paragraph of the chapter has been added to include information on processes to ensure compliance with OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight fundamental conventions identified in the Declaration of the International Labor Organization on Fundamental Principles and Rights at Work and the International Bill of Human Rights.

Disclosure on product level Chapter 3: For transparency reasons a table was added showing the three impact objectives, five key areas and the respective KPIs. Key area related SDGs were added to the Fund’s Five Impact Principles. Disclosure on Chapter 6 and7: Language has been added to be more precise. |

||

| 04 | 09.04.2025 | Document title:

Change of document title from “SFDR Disclosures” to “Sustainability-related disclosures” to correspond to the requirements of Art. 23 of the Delegated Regulation Disclosure on product level Summary section: The summary section has been extended to cover all content required under Article 37 of the Delegated Regulation. In addition, the summary section has been added in German. Disclosure on product level Chapter 5: The section has been supplemented with information and a figure on the asset allocation relating to the Fund’s sustainable investment objectives. |